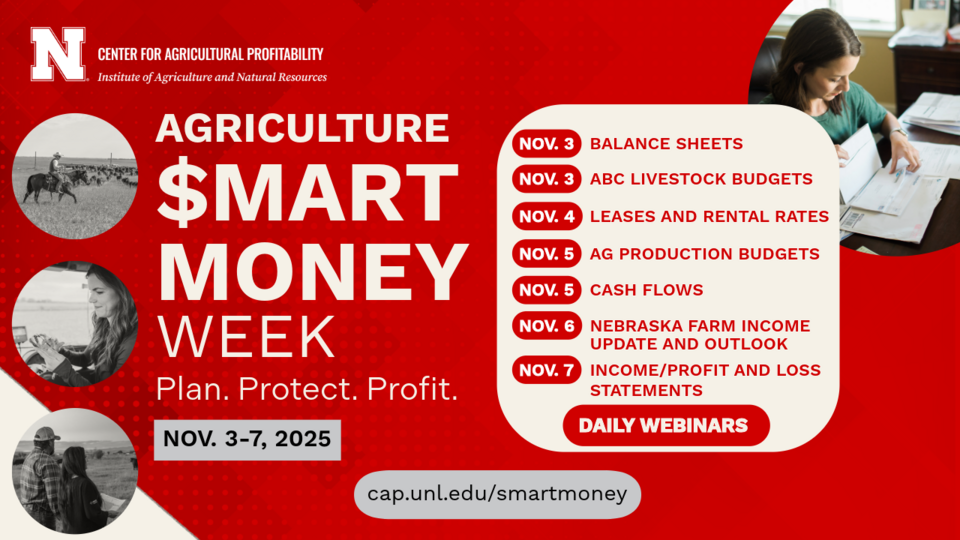

Ag $martMoney Week, Nov. 3-7, 2025, focused on providing education, information, tools, and training for agricultural producers in Nebraska to better manage and improve their operations through free webinars at least once per day during the week.

Areas covered included topics related to finances, cost of production, risk management, land leasing and rental rates, and more.

The goal of the week was to provide education, information, and tools for agricultural producers to help with their operations.

Recordings: Ag Smart Money Week 2025 Webinars

Nov. 3 Noon CT | Building Your Financial Foundation: Balance Sheets Ag Smart Money Week Webinar With Jessica Groskopf, Extension Agricultural Economist, UNL Center for Agricultural Profitability A balance sheet is the cornerstone of understanding your operation’s financial health. This session will show how to build and interpret one using real farm examples to track assets, liabilities, and net worth to see where you stand and how that position changes over time. Participants will learn how lenders view balance sheets, and how to calculate key ratios like working capital, current ratios, and debt-to-asset. |

|---|---|

Nov. 3 6 p.m. CT | Livestock Budgeting with the Agricultural Budget Calculator With Glennis McClure, Extension Farm and Ranch Management Analyst, UNL Center for Agricultural Profitability Livestock operations face unique challenges when it comes to tracking costs and planning for profit. This session focuses on how producers can use the Agricultural Budget Calculator (ABC) to create, compare, and analyze enterprise budgets for cow/calf, backgrounding, and finishing operations. Participants will see how to factor in feed, pasture, labor, and equipment costs, evaluate breakeven prices, and test “what-if” scenarios to guide marketing and herd management decisions. Whether you’re expanding, downsizing, or maintaining your herd, you’ll learn practical ways to make the numbers work for your operation. |

Nov. 4 Noon CT | Leases and Rental Rates: Smart Decisions for Land Management With Jim Jansen, Extension Agricultural Economist, UNL Center for Agricultural Profitability Leasing arrangements and rental rates are among the most important decisions in any farm or ranch business. This session explores current trends in Nebraska’s cash rental rates for cropland and pasture, and offers practical tools for structuring agreements that balance risk and reward for both tenants and landowners. Learn how to evaluate flexible leases, understand regional rate differences, and use UNL Extension’s survey data to guide fair and informed negotiations. |

Nov. 5 Noon CT | Enterprise Budgets: Figuring Your Cost of Production With Glennis McClure, Extension Farm and Ranch Management Analyst, UNL Center for Agricultural Profitability Knowing your cost of production is essential to managing risk and improving profitability. This session will walk through how to build and use enterprise budgets for crops and livestock using the Agricultural Budget Calculator (ABC) tool. Participants will see how to adjust budgets for local input costs, test “what-if” scenarios, and use budget results to guide marketing, leasing, and investment decisions throughout the year. |

Nov. 5 6 p.m. CT | Managing Cash Flow: Timing, Forecasting and Operation Stability With Shannon Sand, Extension Agricultural Economist, UNL Center for Agricultural Profitability A positive bottom line doesn’t always mean positive cash flow. This session breaks down how cash moves through a farm or ranch business, why timing matters, and how to forecast your liquidity position during tight months. Learn how to build a monthly cash flow plan that supports better borrowing, smoother bill management, and stronger relationships with your lender. Real examples will show how cash flow planning can prevent surprises and improve day-to-day decision-making. |

Nov. 6 Noon CT | Nebraska and U.S. Farm Income Update and Outlook – Fall 2025 With: Brad Lubben, Extension Associate Professor and Policy Specialist, University of Nebraska-Lincoln; and Alejandro Plastina, Associate Professor of Agricultural Finance and Director of the Rural and Farm Finance Policy Analysis Center, University of Missouri. Nebraska’s farm income prospects remain mixed for 2025, with lower crop revenue projections buffered by continued strength in the cattle sector and substantial government assistance. The net result is that farm income for the state is projected higher in 2025 even as financial challenges deepen for some producers. While the overall outlook remains strong, it can hide the real concerns in some sectors and the high levels of uncertainty over key production, market, and policy developments that could affect agriculture the rest of this year and into the next. The details are always more complex and highlight the need for a deeper analysis. Join us for a review of the details and the latest farm income situation and outlook for the rest of 2025 and beyond for ag producers. Presented by the University of Nebraska-Lincoln’s Center for Agricultural Profitability and the University of Missouri’s Rural and Farm Finance Center. |

Nov. 7 Noon CT | Profit and Loss Statements: Measuring Profitability and Net Worth Growth (Ag Smart Money Week Webinar) With Anastasia Meyer, Extension Agricultural Economist, UNL Center for Agricultural Profitability Your income (or profit and loss) statement tells the story of how your farm earned or lost money over a given period. This session explains how to move beyond tax records to understand true operational performance through accrual adjustments and net worth reconciliation. |